Over the past 5-10 years, large companies around the world have begun to actively invest in alternative energy. Its supporters and opponents usually name two reasons for such actions – of course, they are diametrically opposed in their ultimate goals. The former see clean energy as the future. The second argue that investors are driven solely by the desire to master government subsidies. In practice, the picture is much more complicated, although it includes both the first and second options.

Approach #1. Earnings on government subsidies

The desire for profit in the short term is inherent in companies entering the markets of states with the maximum rates of “green tariffs” or their analogues. This really brings investors a good profit, and at the same time contributes to the rapid growth of alternative energy capacities in the country.

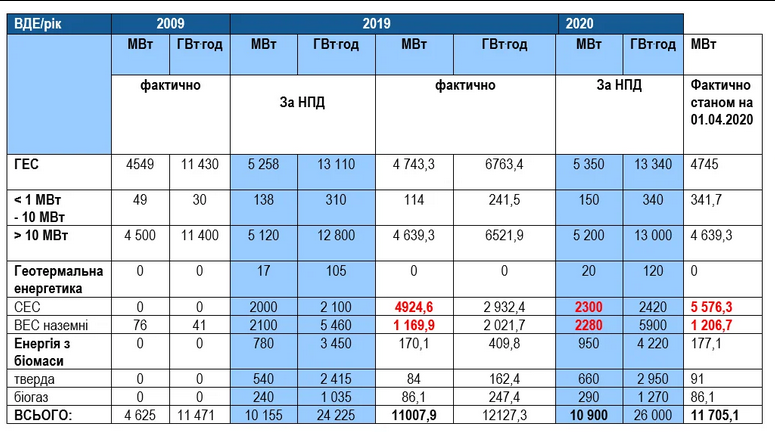

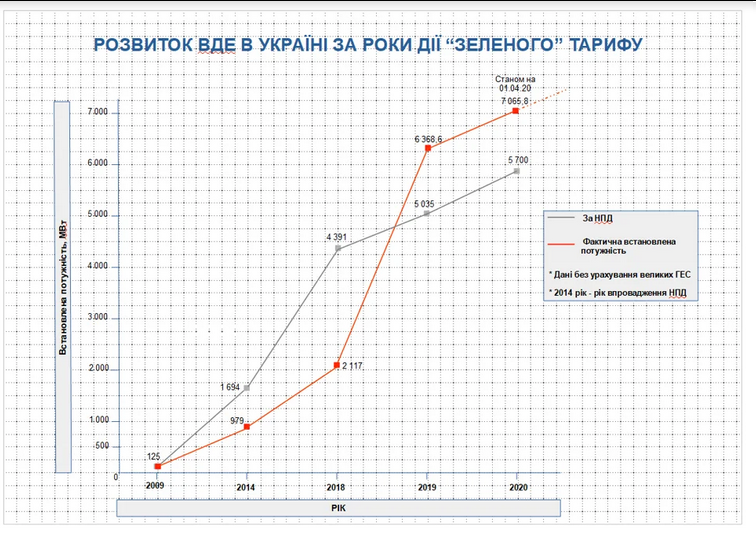

Ukraine can be cited as an example, where the total productivity of solar and wind farms has increased by 800% over the past three years. In 2020, this brought the country to the top 15 world leaders in terms of solar generation, with the prospect of increasing the share of alternative energy to 25% by 2035.

Status of implementation of the National Action Plan (NAP) on renewable energy for the period up to 2020

Approach #2. The goal is long-term benefit

Last year, the Nikopol SPP, with an expected annual generation of 290 mln. kWh, became the largest station in Europe. Its investors were DTEK Renewables BV and the Chinese China Machinery Engineering Corporation.

Since the feed-in tariff rate of the Nikopol SES was set at €0.15 per 1 kWh, this investment path can be called purely pragmatic and designed for large profits.

Approach #2. The goal is long-term benefit

Solar insolation in the countries of the Middle East is almost twice as high as in the vastness of Ukraine and most European countries. This allowed the richest Gulf monarchies to adopt a different strategy. As part of a global project to diversify their economies, the UAE and Saudi Arabia have begun building giant solar parks in the deserts of the Arabian Peninsula. One of them, Noor Abu Dhabi, received 3.2 million photovoltaic panels with an expected annual output of over 3.4 GWh.

The use of the park has not only reduced CO 2 emissions by 1 million tons. tons, but also guaranteed the generation of electricity to the sheikhs at a cost of less than 1 cent per kilowatt. The selling price for consumers is now 2.4 cents, the lowest in the world for any type of power plant.

The project investors were the local emirate of Abu Dhabi, Jinko Solar (PRC) and Marubeni Co (Japan). There is no state subsidy for the sale of this electricity, and 140% of the profitability is provided solely by modern technologies.

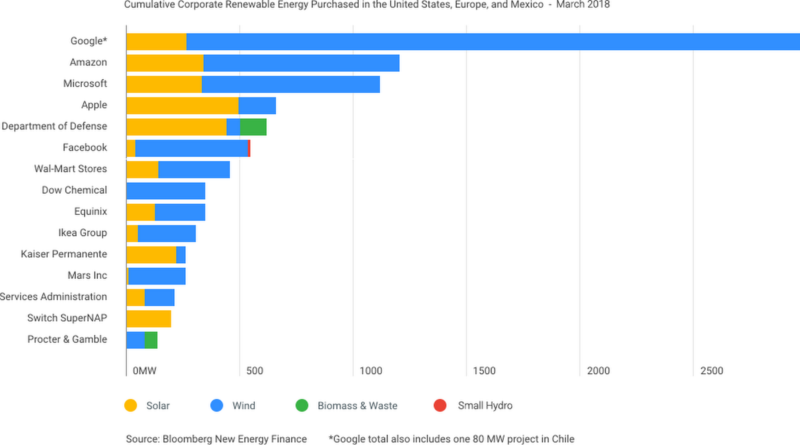

The leaders of the global IT industry also invest in the construction or purchase of powerful stations. For example, Apple began to actively buy solar power plants in California, and Amazon began to build its own solar and wind parks. The last of these, the Texas Wind Farm, has a total capacity of 253 MW.

Approach #3. Purposeful hydrocarbon phase-out strategy

The third strategy of large private companies is implemented, first of all, by the same giants of IT technologies. Here, the main goal is directly called the fundamental rejection of the use of hydrocarbons as sources of “dirty” energy.

With a huge margin among them is Google, which has been purposefully purchasing green electricity for more than 10 years. Since 2018, all DATA centers and offices of this giant have been supplied exclusively from SPPs and WPPs – including regions where it was not economically feasible.

Since the energy needs of IT equipment are huge, Google’s expenditure for this purpose exceeds $3 billion. in year. However, the position of the company’s management remains unchanged – the main reason for buying “clean” energy is the reluctance to use fuel that pollutes the environment.

Approach number 4. Combining profit with the desire to develop solar technology

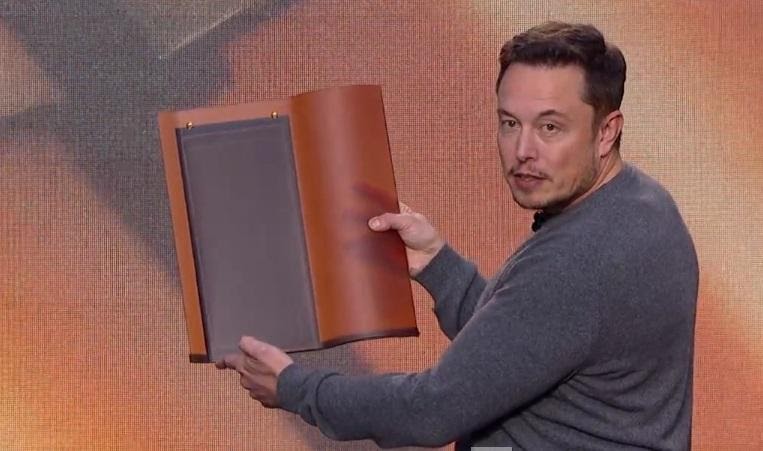

Listing the goals of investing in alternative energy for large companies would be incomplete without mentioning the personality of Elon Musk. The famous visionary found a way to not only make money from solar energy without government subsidies, but also bring benefits to customers.

Elon did not use the way of selling the electricity itself. His Tesla began selling a product that produces this energy – “solar roofs” combined with storage batteries. Installation of photovoltaic panels on the roofs of private houses requires additional investments, and the payback period for photovoltaics of this type is 6-7 years. But for houses under construction, a roof with solar cells already integrated into the tiles costs no more than a classic roof. This makes the acquisition of such housing extremely profitable, since the payback of the project begins from the moment the house is put into operation.

At the beginning of 2020, Elon Musk and Tesla launched the third version of the innovative tiling on the market, and sales reached 1,000 of these houses per week.

Approach number 5. Investments in the development of advanced solar panels

The last direction of investments of large companies in alternative energy should be called investments in the development of new types of photovoltaics. Such costs do not yet generate profit, but in the future they promise to pay off many times over.

Such confidence is based on the extremely low cost and versatility of promising types of panels. As soon as the efficiency of tested prototypes rises from the current 1-4 to 10-15 percent or more, the demand for energy-generating cheap coatings will increase like an avalanche. Instead of profiting from the high price, companies will begin to profit from huge volumes. And, according to experts, this will happen in the coming decades.